new economy, new normal, 2025 china manufacturing, cashless society ... ... these "language flashes" outlines a new picture of the china economy. china has attracted global attention with its rapid growth in economic. goldman sachs, the leading global investment banking, securities and investment management firm also pays attention to china’s economic development.

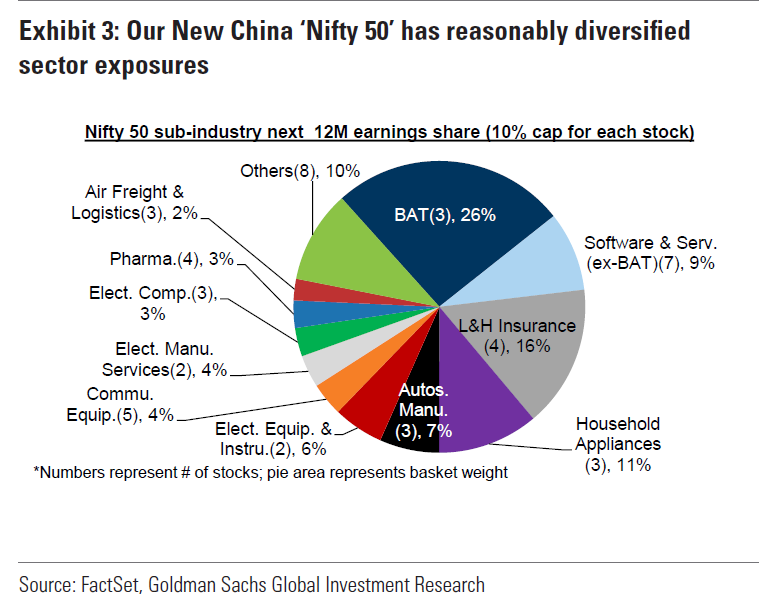

recently, for researching china’s economy, goldman sachs picked up 50 stocks from 18 sub-industries which are called nifty 50.

hengtong is honored to be selected into the nifty 50 as top one of the five communication equipment companies. goldman sachs collected not only according to the company development and expected growth rate, but also considering the technology/ip, business model, return etc which factors are closely related to future earnings growth, profitability and return on.

according to the chart from goldman sachs, the market value of sub-industry of communication equipment takes 4% of the total value of the nifty 50 and bat is the highest, taking 26% of the total market value.

hengtong optic-electric (600487.sh) has successfully went into shanghai stock in august 2003 and kept 29% annual growth in total assets, net annual growth 21.23%, 37.97% annual growth in revenue, average annual increase in net profit to 37.63%. hengtong also released that the revenue of the first half of 2017 hit a new high record of up to rmb 11.413 billion in late of august 29, 2017. the net profit for attributable shareholders increased 100.67% to rmb 767 million and doubled the net profit based on the revenue increase of 41.81%. basic earnings per share increased to rmb 0.62.